Brokers, Service and Platforms

In order to buy and sell currency, you will need to set up an account with a FX broker. There are many brokers online and across the world. You don’t physically need to visit a broker to open an account. It doesn’t matter which country your broker is based in. Money can always be transferred between your trading account and your bank account easily.

My broker is in the United States whilst I live in Europe.

When filling out the application form, you’ll need to specify what type of account you will require (regular, mini or universal if offered).

You don’t need any previous trading experience to open a trading account.

Remember to shop around for the best broker. Look for one who will offer you as many of the items listed below:

• Low spreads for each currency

• No commission (not many charge this nowadays as they make their money from the spread)

• Universal Account allowing you to place either a mini or regular trade from the same account

• See if they offer free training or training material

• A good trading platform with lots of functionality (covered below)

• A reliable service along with good customer service

• Guaranteed fills on all the orders you place (covered later)

• A good range of currencies which can be traded with that broker

• Minimal slippage (covered later)

Make sure your broker is reputable and has been around for some time.

When you place an order to buy or sell a currency, this doesn’t mean that your order will be filled (executed and placed) automatically. There is the odd occasion when your order may not be executed at the price you want – it may be filled a pip or two away from the price you asked for. When this happens, it is known as slippage as the execution has slipped away from the price you wanted to be filled at.

In my opinion, a good functional trading platform is more important than many other factors.

A trading platform is a software package (normally provided by your broker) which contains charts, prices, news, and a whole host of other information which will allow you to make informed decisions and place trades directly from within that platform.

The platform is an easy way to place trades without having to call your broker every time you need to open or close a position.

Not every broker has a fully fledged platform. Some only offer prices on their platform whilst others offer much more.

You don’t even have to use the platform provided by your broker. If you don’t like it, just use any other platform and when you’ve made a decision to place a trade, you can either place it through your own broker’s platform or call them via telephone.

Sometimes, the data (prices and news) which is fed into the platform is provided by a third party who adds to the confusion.

Therefore, it would be much easier and better if you got all the functionality of a good trading platform and a good brokerage service from the same place. This is why it’s important to spend some time researching which broker you’d like to sign up with.

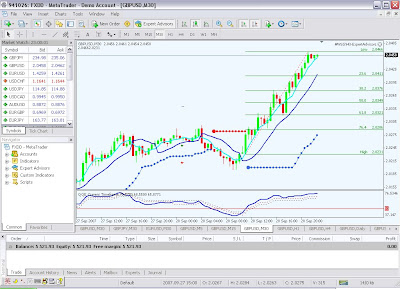

This is what a typical trading platform may look like:

It consists of dealing rates, charts, account information and lots more which can be selected with your mouse.

After you have learnt the techniques of trading the FX market, you’ll be able to place trades by simply clicking on the currency name or some other easy method (depending on the platform).

Almost every broker will have a live version and a demo version of the trading platform.

You can download the trading platform free of charge from the broker’s website.

You need to start with a demo version as this is used for practice.

With the demo version, the price and chart movement is all real. It happens in real time and you can place trades as you would do with real money. Remember, price will move continuously throughout the day and so you’ll be making money, losing money or sitting aside. The difference being the X amount of money in your demo account is just dummy cash. With this, you can practice and test your theories before committing yourself with real money on a live account.

New traders should spend at least 3 months demo trading (also called paper trading). This will allow you to get familiar with the trading platform, Forex routines & terms and will allow you to test various systems and your beliefs.

When you trade a real account, you will be distracted by many emotions which will eventually lead to bad trades. Although a demo platform won’t eliminate those emotions, it will put you in a position from where you can progress further.

Before you continue reading the remainder of this manual, you need to download the charting software I use so you may follow along.

I use the “Meta Trader 4” Platform offered by FXDD (Broker). Visit their website and open a demo account. Download the trading platform so you can follow everything you learn in this course. The website is located at www.fxdd.com.